Economía y bien común para el futuro (XXI). Progreso y Prosperidad

Progreso y Prosperidad. Después de haber colgado en este blog cinco posts

dedicados al tema de la deuda pública y la teoría monetaria moderna,

recuperamos la serie previa relacionada con la cuestión de “economía y

bien común para el futuro”, realizada bajo los auspicios de la Fundación

Cultural Ángel Herrera Oria (ACdP).

Lo hacemos revisando el último tema al que se refiere el libro de Ben Ansell, Por qué fracasa la política,

el cual está destinado a analizar el papel de los políticos y de los

gobiernos en la marcha de las sociedades actuales y a identificar los

fallos corrientes en que incurren. Recordamos que este autor sintetiza

la función de los gobernantes en cinco áreas específicas: democracia,

igualdad, solidaridad, seguridad y prosperidad. En cada una de ellas

identifica lo que llama trampas y explica los fracasos en la caída de

los gobernantes en ellas.

En el caso de la Prosperidad, máximo y definitivo estado al

que los hombres y los distintos países deberíamos tender, señala como

trampa la siguiente: lo que a corto plazo nos enriquece a largo plazo nos empobrece.

(Imagen de arriba: Golfo de California)

Mejora a corto plazo de las variables económicas básicas en España

Justo en los días en que volvemos a la serie de posts de este blog

dedicada a la economía y bien común para el futuro se publican datos

bastante positivos sobre el crecimiento y la inflación en nuestro país.

El crecimiento del PIB para 2024 se sitúa, según las últimas

predicciones, entre un 2,7 y un 2,9 % dependiendo de la institución que

las ha hecho. Para los años 2025 y 2026 las predicciones del Gobierno

español son, respectivamente, de 2,4 % y de 2,2 %.

La inflación se ha moderado de forma muy importante también, bajando a

finales de septiembre hasta el 1,5 % anual. Con la subyacente (sin

contar los alimentos frescos y la energía) situada en el 2,4 %.

Son datos a los que hay que dar la bienvenida en una época de

crecimiento muy bajo en la UE: alrededor del 1.0 % previsto para este

año y algo menos, alrededor del 0.8 %, en la Eurozona. Así como de una

mejora notable de la inflación que ha bajado desde el 2022 y que se

espera hoy que sea en la UE de un 2,7 % en 2024 y de un 2,2 en 2025.

El empleo también ha mejorado en la UE, lo cual sorprende un poco a

la vista de los bajos crecimientos indicados. En 2023 se crearon más de 2

millones de puestos de trabajo y en marzo de 2024 el desempleo alcanzó

el mínimo histórico de. 6,0 %-

En España, sin embargo, el desempleo sigue siendo el más alto de la

UE, con un 11,5 %, tasa inferior a la existente en 2023, que fue del

12,1 %. Y eso a pesar de haber introducido la fórmula del “empleo

discontinuo” que no deja de corregir el dato a la baja.

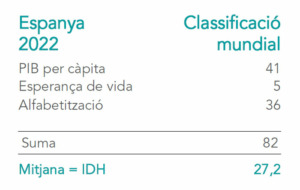

Deterioro de otras variables más estructurales

Estas variables muestran unos valores bastante volátiles y no

resultan muy adecuadas para ver si nuestro país, en particular, progresa

adecuadamente. Hay que prestar atención, de hecho, a dimensiones más

estructurales, como. por ejemplo, la pobreza y su evolución, la

desigualdad, la renta per cápita, el PIB per cápita, la productividad,

la inversión industrial y otras, a las que nos hemos referido en posts

anteriores.

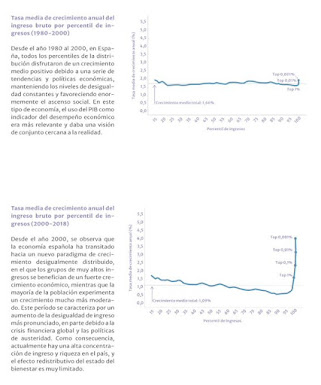

Los índices de pobreza y desigualdad, por ejemplo, tampoco muestran

resultados favorables en nuestro país. En 2023 el 26,9 % de la población

española estaba en situación de riesgo de pobreza o exclusión social. Y

en cuanto a desigualdad se está produciendo el fenómeno de que los que

menos tienen son los que más empeoran. Con datos como que en los último

cinco años los salarios han aumentado un 6 % y solo la vivienda ha

tenido un incremento del 15 %, o que un 50 % de la población española

ingresa menos de 21.000 Euros al año.

Resulta claro entre nosotros la desaparición o deterioro de la clase

media ya que, por ejemplo, tras la pandemia y otras crisis posteriores,

un 70 % de la población española ha visto empeorada su situación, con un

paso creciente de deterioro para los segmentos más bajos y aumento

bastante elevado de mejora para los más altos.

En el índice 80/20, que mide los ingresos totales del 20 % de la

población más rica en comparación con el 20 % de la población más pobre,

utilizando datos de 2021, año en el que la desigualdad aumentó,

presentábamos un valor de 6,19 y ocupábamos el lugar cuarto de la UE,

tras Bulgaria, Rumanía y Letonia. Para el conjunto de la UE dicho índice

mostraba un valor del 4,97.

Una visión positiva del progreso y la prosperidad

Ya hemos indicado que España parece deteriorarse poco a poco y

descender en el ranking de países desarrollados, y eso,

independientemente de las mejoras a corto plazo, que no vamos a discutir

ni menospreciar. Es la estructura y la dinámica lo que resulta

preocupante. Pero, no vamos tampoco insistir en ello. Más bien nos toca

ahora hablar de progreso y prosperidad y de cómo se consiguen estos

objetivos deseables para cualquier sociedad.

Para ello vamos a distinguir entre cuatro temas: crecimiento

económico, desarrollo económico y social, progreso y prosperidad, al que

nos referiremos en posts posteriores al presente. Para consideraciones

sobre el último, la prosperidad, vamos a utilizar en parte el libro de

Ben Ansell, Por qué fracasa la política (Península 2023), tal como hemos hecho en posts anteriores. Nos apoyaremos también en otras publicaciones recientes como, Poder y Progreso, de Daron Acemoglu y Simon Johnson (Deusto 2023); Camino a la Utopía. Una historia Económica del Siglo XX, de J. Bradford Delong (Deusto 2023); La crisis del capitalismo democrático, de Martin Wolf (Deust0 2023); El desconcierto democrático, de Michael J. Sandel (Debate 2022) y de varios otros citados en posts anteriores.

Todos ellos nos hablan del fin del capitalismo, del deterioro de la

democracia, de las crisis políticas actuales, de la conflictividad

mundial, de las revoluciones tecnológicas en marcha y sus posibles

impactos negativos, de la sostenibilidad del planeta y las dificultades

para conseguirla, del pesimismo ante el futuro y de otras mil graves

cuestiones actuales.

Venimos de un pasado tenebroso como muy bien recuerda Ansell en su libro citando a Thomas Hobbes

(1588-1679), quien consideró que la vida humana era “solitaria, pobre,

desagradable, brutal y corta”. Pero al revisar la historia de los

últimos siglos con las diversas revoluciones industriales que han tenido

lugar desde mediados del siglo XVIII, con el papel destacado de la

tecnología y con épocas de fuerte desarrollo económico y social, como la

de los treinta años gloriosos posteriores a la segunda guerra mundial,

Ansell sugiere que es posible también que la vida del hombre se vuelva

“sociable, rica, agradable, sofisticada y larga”.

La trampa de la prosperidad

Lo que llamamos Prosperidad es la consecución de ese objetivo para la

humanidad y, de hecho, algunos países, en algunas épocas y bajo

determinadas circunstancias se han acercado a una “buena vida” o una

“vida satisfactoria” para una mayoría de sus poblaciones.

Ansell, que dedica su libro a revisar el papel de la política en

cuanto a alcanzar dicho objetivo y a los fallos que se producen en ello,

habla, como en los otros temas tratados en su libro, de la “trampa de

la prosperidad”. La formula diciendo que es: lo que a corto plazo me enriquece a largo plazo me empobrece.

Destaca en relación con ello que los políticos dependen de ganar

elecciones y esto a su vez está relacionado con el corto plazo. Muy poca

gente está dispuesta a sacrificarse en el presente para asegurar el

futuro. Ni siquiera la llamada a sacrificarse en el presente por el bien

de nuestros hijos y de las generaciones futuras tiene mucho atractivo

hay en día, en relación, por ejemplo, con la protección del medio

ambiente.

En realidad, los cinco temas tratados por Ben Ansell en

su libro, democracia, igualdad, solidaridad, seguridad y prosperidad,

que son a los que los gobiernos y los políticos deberían dedicarse,

tienen todos que ver con el enfrentamiento entre lo individual y lo

colectivo y con la actuación a corto y a largo plazo.

Con la particularidad de que surge de nuevo entre nosotros la idea de

equilibrio en nuestras actuaciones. Ni resulta válido defender el

extremo del individualismo y el liberalismo económico sin más, como

hacen los libertarios, ni el colectivismo absoluto ha dado buenos

resultados como han demostrado las experiencias comunistas vividas en

nuestro mundo.

Cómo evitar la trampa de la prosperidad

A la hora de hablar de actuaciones para evitar la trampa de la

prosperidad o, lo que es lo mismo, al hablar de actuaciones a corto

plazo que no deterioren las condiciones de vida a largo plazo de un

país, Ansell no hace grandes propuestas. Simplemente revisa países con

éxito sostenido a lo largo de los años tal como el caso de la industria

alemana y su colaboración estrecha con el sistema bancario que acuerdan

una financiación a largo plazo basada en la confianza y el esfuerzo.

También el caso de Finlandia y sus sistemas de apoyo a las start-ups y

a las empresas medianas y pequeñas innovadoras. El de Taiwan basado en

una mejora continua de empresas de tecnología avanzada. El del Estado

emprendedor propuesto por Mariana Mazzucato.

El de Canadá como buen uso del sistema financiero y de su regulación.

El de Noruega como un ejemplo de buen uso de los recursos naturales en

beneficio de todos sus habitantes.

Aborda también el caso de la protección medioambiental especialmente

en cuanto al control de las emisiones resultado del uso del carbón.

Después de analizar diversas medidas posibles, muchas de ellas ya

ensayadas, se inclina por un uso adecuado de los impuestos.

Se detiene bastante, por fin, en el papel de los impuestos en gen

eral, de lo que es bastante partidario siempre que se utilicen

inteligentemente y en beneficio de todos.

Doctor Ingeniero del ICAI y Catedrático de Economía Aplicada,

Adolfo Castilla es también Licenciado en Económicas por la Universidad

Autónoma de Madrid, Licenciado en Informática por la Universidad

Politécnica de Madrid, MBA por Wharton School, Master en Ingeniería de

Sistemas e Investigación Operativa por Moore School (Universidad de

Pennsylvania). En la actualidad es asimismo Presidente de AESPLAN,

Presidente del Capítulo Español de la World Future Society, Miembro del

Alto Consejo Consultivo del Instituto de la Ingeniería de España,

Profesor de Dirección Estratégica de la Empresa en CEPADE y en la

Universidad Antonio de Nebrija.